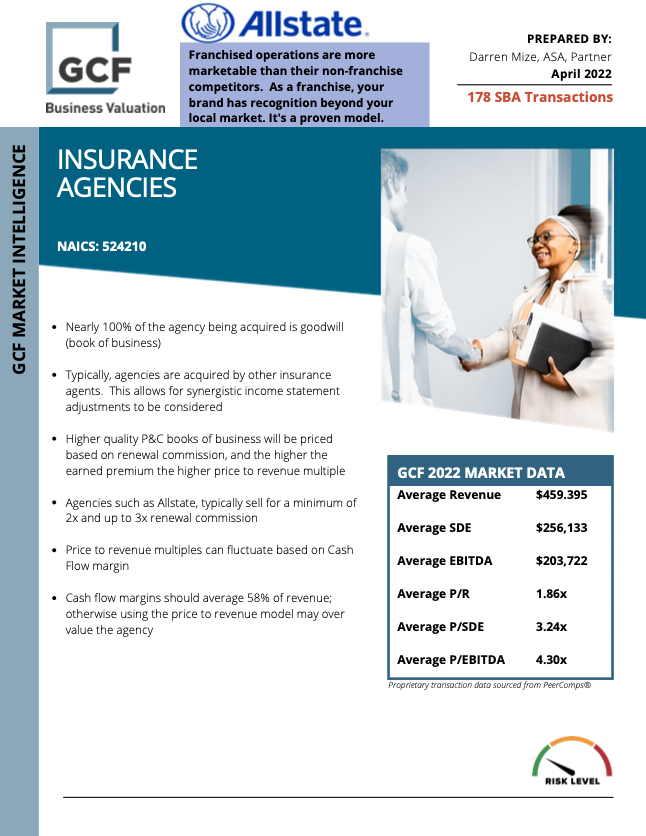

Allstate Insurance Agency Business Valuation

As with most businesses, one of the major advantages to owning a recognized national brand, is of course, the brand recognition itself. For this reason, the brand increases the marketability of the subject company to potential buyers. That makes an Allstate Insurance Agency a great investment.

Why you need a valuation for your Allstate Insurance Agency

Whether you are an Allstate Agency owner or you're looking to buy one, there will come a time when you’ll need a business valuation to guide key decisions. Here are our top 8 scenarios in which you’ll need a business valuation:

- SBA Lending

- Sale, Merger, or Acquisition

- Business Planning

- Employee Stock Ownership Plan (ESOP)

- Gift Tax / Estate Tax

- Corporation Tax Filing Status

- Partner Buy-Outs / Disputes

- Marital Dissolution

For more information about why you may need an appraisal, read our blog.

Unlock More Allstate Insurance Agency Business Valuation Insights with PeerComps

The data in your report is just the beginning. With PeerComps, you can dive deeper into this industry and access accurate, real-time data across multiple sectors. Elevate your decision-making with the powerful combination of experience and data-driven insights.

Keep learning about Business Valuations

- How to Navigate the Business Valuation Process

- Different Types of Business Valuations

Business Valuation Accreditation

Your GCF Business Valuation appraisal team has one or more of the following business valuation accreditations:

Accredited Senior Appraiser (ASA) - is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Accredited Senior Appraiser (ASA) - is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Certified Business Appraiser (CBA) - a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being the industry’s most difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Business Appraiser (CBA) - a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being the industry’s most difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Valuation Analyst (CVA)

Certified Valuation Analyst (CVA) Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) - a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) - a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Accredited in Business Valuation (ABV) - credential is granted exclusively by the AICPA to CPAs and qualified valuation professionals who demonstrate considerable expertise in valuation through their knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Certified Public Accountant (CPA)

Over 25 years of experience and expertise in business valuations and appraisals. An accredited appraiser receives extensive training, remains in good standing, and follows specific industry practices to determine the value of a business.

GCF's Machinery and Equipment Appraisal Accreditations

Expert Equipment Certified Appraiser (EECA) - Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

Expert Equipment Certified Appraiser (EECA) - Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

- Certified Machinery and Equipment Appraiser (CMEA) - a CMEA professional has the expertise and certification to conduct a third party machinery and equipment appraisal.

The GCF Business Valuation Process