How to Value a Small Business for Sale: A Comprehensive Guide

When selling a small business, the goal is always to maximize shareholder value and avoid leaving money on the table. Achieving this starts with an accurate business valuation. Since selling a privately held business can take a year or more, accuracy in valuation is crucial. An independent business valuation not only ensures accuracy but also helps set realistic market expectations for the owner. Additionally, it provides a clear starting point for qualified prospective buyers, which can streamline negotiations and lead to a quicker closing process.

Why Business Valuation Matters

Many small business owners often overestimate the value of their business. An independent business valuation helps establish realistic market expectations before listing the business for sale. By pricing the business in line with market value, sellers can attract more qualified buyers, lending credibility to the listing price.

Having a valuation backing the asking price reduces the likelihood of buyers starting negotiations with a much lower offer. This shortens the negotiation period, leading to a faster agreement between buyer and seller, and ultimately, a quicker move to the Letter of Intent (LOI).

Key Business Valuation Methods

1. Income-Based Approach

This approach relies on two main components: cash flow (fact-based) and risk (subjective). Cash flow is derived from the company’s financial statements, while risk is analyzed based on factors like operations, industry, and economic trends. The appraiser’s risk analysis translates into a Capitalization Rate (Cap Rate), forming the foundation of the Income Approach.

Two methods within this approach are:

- Capitalization of Earnings (based on Net Cash Flow or Seller’s Discretionary Earnings) and

- Discounted Cash Flow (DCF).

The method used depends on the size of the business, financial trends, and earnings levels. For smaller businesses, the Capitalization of Seller’s Discretionary Earnings (SDE) is most common. However, once SDE reaches $600,000, Capitalization of Net Cash Flow becomes more typical.

The Capitalization of Earnings method works best for businesses with stable or slightly fluctuating earnings. In contrast, Discounted Cash Flow is used when earnings are consistently trending upward or downward. These two methods are contradictory and are never used together in a valuation.

2. Asset-Based Approach

This approach focuses on the value of the company’s assets as listed on the balance sheet. Assets can include operating items like inventory and equipment, or a combination of assets and liabilities. The Asset Approach is only used when the balance sheet value exceeds the cash flow from the income statement.

3. Market-Based Approach

The Market Approach compares the subject company to others within the same industry that have been acquired. This method operates on the Principle of Substitution, which states that a buyer will not pay more for an asset than the price of a similar, comparable asset. Key comparability factors include revenue, cash flow, margins, and sale prices relative to Price to Earnings (P/E) ratios. These P/E ratios are applied to the subject company to estimate its value.

Steps to Conduct a Business Valuation

1. Gather Financial Documents

Gathering financial documents is a critical and often time-consuming step in the valuation process. Patience is necessary, as this stage heavily influences the final valuation. Typically, three years of historical financial statements (tax returns or CPA-reviewed statements), along with year-to-date (YTD) profit and loss statements and balance sheets, are sufficient. It’s also important to account for any non-business, one-time, or personal expenses, which need to be isolated for adjusted cash flow calculations.

If possible, eliminating personal expenses from financial statements (and paying any related taxes) can simplify the process and reduce perceived financial risk.

2. Calculate Earnings and Adjustments

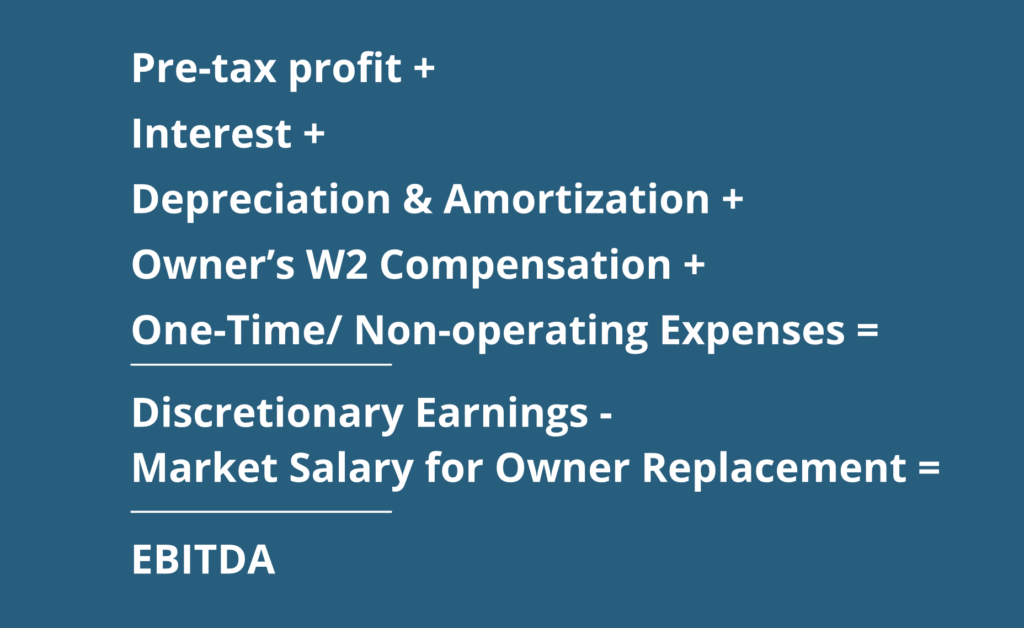

Personal expenses, also known as add-backs or income statement adjustments, are the starting point for calculating normalized cash flow (SDE or EBITDA). The calculation is as follows:

3. Apply Business Valuation Method(s)

With three main approaches, selecting the right method is straightforward. The Asset Approach is typically used only when the balance sheet assets have more value than cash flow, so it’s less common. This leaves the Income and Market Approaches.

For the Market Approach, the decision to use it depends on the quality of available market data. It’s not a requirement, but if you trust the data, you may choose to weight this method. If not, you may decide not to use it at all.

In the case of the Income Approach, your choice of method depends on financial trends. If performance is steady with only minor fluctuations, the Capitalization of Earnings method is preferable. However, if the business is experiencing strong growth or significant declines, the Discounted Cash Flow method is more appropriate.

Regardless of which methods you choose, it’s important that the weighting of approaches equals 100%.

Factors Influencing Business Value

While cash flow and risk are the primary drivers of business valuation, other factors also play a role. These include industry trends, sector performance, and current economic conditions. Specific factors related to the business—such as location, size (both revenue and profit), growth potential, and proprietary products—can also influence value. Intangible assets, which are also included in the final value, like patents or copyrights, may enhance marketability (improve value) as well.

Common Challenges in Valuation

A common misconception is that goodwill is added on top of a company’s final value. However, goodwill is part of the intangible value already included in the overall valuation.

Another challenge occurs when sellers and buyers have differing valuations. If both appraisers are accredited and qualified, their valuations should not differ significantly. The issue arises when one or both appraisers lack the necessary qualifications, leading to dramatically different conclusions. It’s essential to ensure that an appraiser holds appropriate business valuation credentials.

When it’s time to list a business for sale, having an independent valuation can significantly increase your chances of success. It helps set realistic market expectations, attracts qualified buyers, reduces negotiations, and leads to a faster closing process.

Keep Learning About Business Valuations

How to Navigate The Business Valuation Process Successfully

The Great Debate: Business Valuation With or Without Inventory

What Is Business Valuation? Why & When You Need One

Our Accreditations

Your GCF Business Valuation appraisal team has one or more of the following business valuation accreditations:

Accredited Senior Appraiser (ASA) – is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Accredited Senior Appraiser (ASA) – is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Certified Business Appraiser (CBA) – a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being a difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Business Appraiser (CBA) – a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being a difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Valuation Analyst (CVA)

Certified Valuation Analyst (CVA) Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) – a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) – a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Accredited in Business Valuation (ABV) – credential is granted exclusively by the AICPA to CPAs and qualified valuation professionals who demonstrate considerable expertise in valuation through their knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Certified Public Accountant (CPA)

Over 25 years of experience and expertise in business valuations and appraisals. An accredited appraiser receives extensive training, remains in good standing, and follows specific industry practices to determine the value of a business.

GCF’s Machinery and Equipment Appraisal Accreditations

Expert Equipment Certified Appraiser (EECA) – Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

Expert Equipment Certified Appraiser (EECA) – Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

- Certified Machinery and Equipment Appraiser (CMEA) – a CMEA professional has the expertise and certification to conduct a third-party machinery and equipment appraisal.