Business Valuation for Construction

Due to the complex nature of the construction industry, engaging a qualified business appraiser is an important first step in accurately determining a construction company’s value. Essential components such as Working Capital Requirements, Work in Progress (WIP), and dependence on Machinery and Equipment (M&E) significantly impact financial performance and must be analyzed in detail when arriving at an accurate value conclusion.

Understanding Business Valuation for Construction

The most common standard in business valuation is Fair Market Value, defined as a hypothetical, cash-based transaction without pressure to buy or sell, where all parties have relevant knowledge of the facts. Business valuations from a qualified appraiser not only offer credible support to the listing price but can also facilitate financing during ownership transitions.

Key Factors in Construction Business Valuation

Financial Performance

The foundation of a company’s valuation lies in the strength of its financials, more specifically in its cash flow. Clean, well-maintained financial statements with minimal adjustments are essential to maximizing value. Ideally, preparation should start 2-3 years in advance to provide appraisers with sufficient data for identifying key trends over that timeframe. Key aspects include:

- Operating Assets: Analysis of WIP, Working Capital Trends, CapEx requirements, and Return on Assets.

- Cash Flow Trends: Consistency of cash flow margins, typically 14% (EBITDA) to 19% (SDE) of revenue, will influence the valuation. Anything outside of those averages will impact the value higher or lower.

- Capital Expenditures: For companies with significant M&E investments, assessing adequate CapEx is vital to calculate debt-free net cash flow accurately.

Market Conditions

A Construction company’s performance is often tied to economic cycles. Revenue and cash flow can fluctuate with broader economic trends. Government contracts, common for larger companies, add a layer of sensitivity. Appraisers often use weighted average cash flows to reflect these fluctuations in determining the final valuation. Local market conditions, although usually aligned with national trends, may vary due to rapid regional development.

Assets and Liabilities in Business Valuation for Construction

Construction companies often hold various levels of M&E, either owned or leased. Identifying which assets generate cash flow is essential, with the assets that aren’t being labeled as excess. Machinery appraisals can help determine asset longevity and CapEx benchmarks. While real property isn’t factored into operational value, fair rent assumptions are used in cash flow calculations. Liability analysis, especially for M&E, is also crucial when those liabilities are included in the transfer of ownership.

Learn More About Machinery and Equipment Appraisals Here

Work in Progress (WIP) and Backlog

WIP, commonly recorded on balance sheets, is a key metric to look for in future revenue and cash flow projections. Because WIP is considered an operating asset, it must transfer with the sale. Project backlogs, analyzed over several years, reveal trends vital for realistic projections. Because backlog is a key indicator of the future, Discounted Cash Flow (DCF) is often the preferred income approach when appraising a construction company.

Valuation Methods for Construction Businesses

Income Approach

The DCF method calculates the present value of future cash flow and is preferred for larger companies with consistent growth or decline. Accurate projections are essential, blending historical performance with operational changes. Conservative growth assumptions yield more defensible valuations.

Market Approach

Transaction data for construction companies is widely available and sufficient for comparison. While exact matches aren’t required, most construction companies share financial structures that allow for a reliable market approach comparison.

Asset-Based Approach

Some companies may have higher asset value than the cash flow they generate. In such cases, an M&E appraisal can be useful, although it’s not always mandatory. In these cases, the Cost Approach (balance sheet focused), would be used.

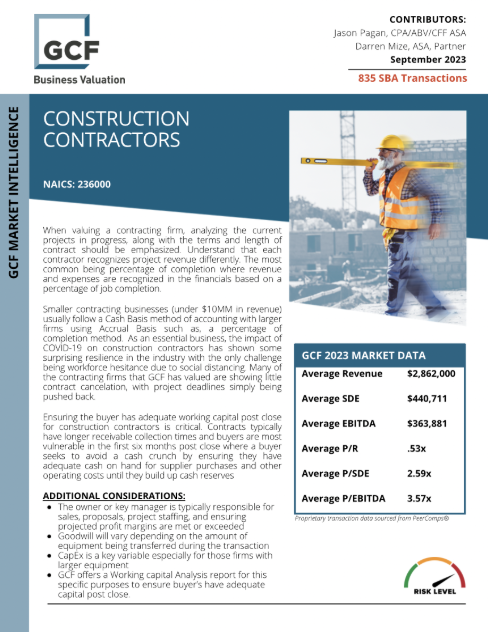

When valuing a contracting firm, analyzing the current projects in progress, along with the terms and length of the contract should be emphasized. Understand that each contractor recognizes project revenue differently. The most common is percentage of completion where revenue and expenses are recognized in the financials based on a percentage of job completion. Download The Construction Contractors Market Intelligence Report to learn more.

Challenges in Construction Business Valuations

A major challenge in this industry is the variability in project size and timelines, leading to inconsistent financial performance and cash flow fluctuations. Competitive bidding practices, while increasing top-line revenue, will unfavorably impact COGS and overall cash flow margins. With this industry showing tight margins at 20% of revenue, competitive bidding can significantly impact the value, especially if this is a regular practice.

Valuing construction companies requires acknowledging their unique aspects. Engaging a qualified appraiser ensures these factors are considered, leading to accurate and reliable business valuations and a smoother negotiation process with potential buyers.

Keep Learning About Business Valuations

How to Navigate The Business Valuation Process Successfully

The Great Debate: Business Valuation With or Without Inventory

What Is Business Valuation? Why & When You Need One

GCF’s Machinery and Equipment Appraisal Accreditations

Expert Equipment Certified Appraiser (EECA) – Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

Expert Equipment Certified Appraiser (EECA) – Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

- Certified Machinery and Equipment Appraiser (CMEA) – a CMEA professional has the expertise and certification to conduct a third-party machinery and equipment appraisal.

Our Accreditations

Your GCF Business Valuation appraisal team has one or more of the following business valuation accreditations:

Accredited Senior Appraiser (ASA) – is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Accredited Senior Appraiser (ASA) – is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Certified Business Appraiser (CBA) – a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being a difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Business Appraiser (CBA) – a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being a difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Valuation Analyst (CVA)

Certified Valuation Analyst (CVA) Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) – a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) – a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Accredited in Business Valuation (ABV) – credential is granted exclusively by the AICPA to CPAs and qualified valuation professionals who demonstrate considerable expertise in valuation through their knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Certified Public Accountant (CPA)

Over 25 years of experience and expertise in business valuations and appraisals. An accredited appraiser receives extensive training, remains in good standing, and follows specific industry practices to determine the value of a business.